NRS

This trade makes trading look easy. First I was looking to get pushed up to the daily resistance of several weeks ago 32.50. It tried and just didn't happen. Momentum shifted , ( RSI sloping down) while the stock could not make a new high. It showed weakness, and I was able to short it near its today's top. I was ready to exit at the first sign of strength , having in mind it still may get to that daily resistance 32.50 ( look left on daily chart). I was right immediately ( doesn't happen too often) then the stock traded exactly by the book, traveling between the intraday support and resistances , with no surprises. Gain was $1.00. Just got lucky staying in it during all the swings between supp res lines .

NRS the short entry

NRS

GLUU

I got stopped out with 4 cents loss was hard to trade this EOD, since the major move was already done in the AM

GLUU

CRR

I took this short EOD just for the hell of it, because had bounced of major daily resistance , broke even, scratch.

CRR

Stay disciplined and green

Salute

My name @DaChopa comes from being chopped out so badly for many years by the markets. I just share my experience real time to save sheep from being taken to the slaughter house.Do not copy my trade alerts.Just watch me trade live and understand the concept. Play small if you are new, very very small just to be in the game long enough to learn it. The only way to learn it is to stay in the gladiator arena long enough.You are entering a losing game before you plan to have any steady profits.

Great Savings

Thursday, April 30, 2015

Wednesday, April 29, 2015

TSLA NUGT BPTH CLNE

TSLA

I tried this short soon after open. The idea was it will fake break of HOD. I got stopped , and never re-entered just to see it go all the way down. There was no really any particular set up was just trying to get lucky because I didnt see anything else in the AM.

TSLA no particular set up

TSLA the second stop Fed's day

NUGT

I was hesitating since it is gold stock, and Fed's day but being three days up and showing intraday momentum weakness was a good short. Second try was a nice winner covered the prev loss plus some more

NUGT

BPTH

Since I missed the great multi day runner short CLNE I got stubborn with BPTH on its first day run, and took a loss 3 times which was gonna be an end for today form me but saw another good entry 1.83 so entered 4th time .

I tried this short soon after open. The idea was it will fake break of HOD. I got stopped , and never re-entered just to see it go all the way down. There was no really any particular set up was just trying to get lucky because I didnt see anything else in the AM.

TSLA no particular set up

TSLA the second stop Fed's day

NUGT

I was hesitating since it is gold stock, and Fed's day but being three days up and showing intraday momentum weakness was a good short. Second try was a nice winner covered the prev loss plus some more

BPTH

Since I missed the great multi day runner short CLNE I got stubborn with BPTH on its first day run, and took a loss 3 times which was gonna be an end for today form me but saw another good entry 1.83 so entered 4th time .

BPTH

BPTH

CLNE is the one I had on watch but missed, I think there were no borrows , or so !?!

This is how I planned to trade it in a hind-side ...

CLNE

NOTE :

When I am shorting from daily overhead resistances I should have more faith. Maybe be more tolerant with the tight exits and burning commissions with all the slippage.barely br. even on the short $BPTH trade ( the 4th times was the charm)

Tuesday, April 28, 2015

FCX green day nice so far HIVE UEC all shorts

FCX

Im trading this in and out have no time to tweet all the entries and exits but the idea is clearly explained. Great green day so far .

FCX

UEC great trading with limited risk, in n out no time to tweet but same idea like FCX

UEC

HIVE

GREK

GREK the cover at EOD

Im trading this in and out have no time to tweet all the entries and exits but the idea is clearly explained. Great green day so far .

FCX

UEC great trading with limited risk, in n out no time to tweet but same idea like FCX

UEC

HIVE

Took some profit early in hope to leave some for home run maybe on this short , maybe all day fade ?!?

HIVEHIVE

GREK the easy short

GREK

GREK the cover at EOD

Monday, April 27, 2015

Red day CLF was a bummer

Its only the CLF worth noting here as stubborn attempt to be right

ACTG

It is always easy to say "I covered too early " after the fact..

ACTG

PBR

Same here "covered too early" ...yeah right...

PBR

IMH

Short by the book , and covered by the book

IMH

MOBI

CLF gave the short trade from the AM took a very tiny profit, and then kept being stubborn during intraday choppiness trying to short it, till I got long and got faked out. Not regretting the loss on the long, but regretting the loss of focus on the re-short which I didnt do. Dropped nicely but I was not in..That was my main reason for having a red day. Everything else I am ok with .

CLF

AGEN

Friday, April 24, 2015

April 24 Green day barely because of some longs: CLF T AMZN ACTG

This green day was gonna be much more greener if I didn't do longs, but hey if I don't try Ill never know.

T ( AT&T)

T was the short that got stopped with small loss. But I stalked the stock and re-entered again for a gain. Used RSI divergence to exit.

T the stopp

T the come back

CLF

First did one little short gainer, then tried long couple of time but didn't work out till the short did later in the day. I guess timing on the longs was after the stocl lost the momentum. How would I know it lost momentum ? Down-sloping RSI , hellooo ...what was I thinking...

CLF the first short winner and the 2 longs losers

CLF RSI divergence helps in locking profit

AMZN

Wish I didn't Skyped and listened my buddy saying "Are you crazy shorting the best company" so left lotta money at the table covering too early.

AMZN the short

AMZN leaving $$$ at the table

AMZN EOD

ACTG

ACTG was another long attempt , testing the theory if something is overextended it may go much much higher. Yes it can happen but the odds are very small so far. It is much easier to wait for the stocks that went much much higher to short them , then to guess which one of hundreds will be the one that may go much much higher and to have a good long trade. A very small percentage of all the stocks go to the moon, and till I nail the right one I may lose few accts. So I am sticking with shorting already overextended stocks.Why fix something that it is not broken ?!? For long I rather look for early break outs, basing from nice supports , but even then many of those do not go where I want them to. Once the stock is already up there , I know there will be some longs taking profits. It is never a sure thing, my risk is very limited I do a lot of in and outs which is costly and overall profit is much smaller, but for me works better. Nothing is easy but this is my comfort zone that I found after many years of losing.

ACTG the long

ACTG the stop

ACTG sure enough this is what I missed setting my mind for long

Stay disciplined to make it green !

Salute

Thursday, April 23, 2015

Red day tough trading NEON WUBA ECHO VALE SPY

The green streak is broken but stayed calm and traded by the rules. It is interesting how I never have many green days in a row going long like I do have when shorting. Only by shorting I can actually have green days even when markets are strong. I don't know why is that but it is a fact in my case. So ill stick with shorting till proven the opposite.

VALE

VALE

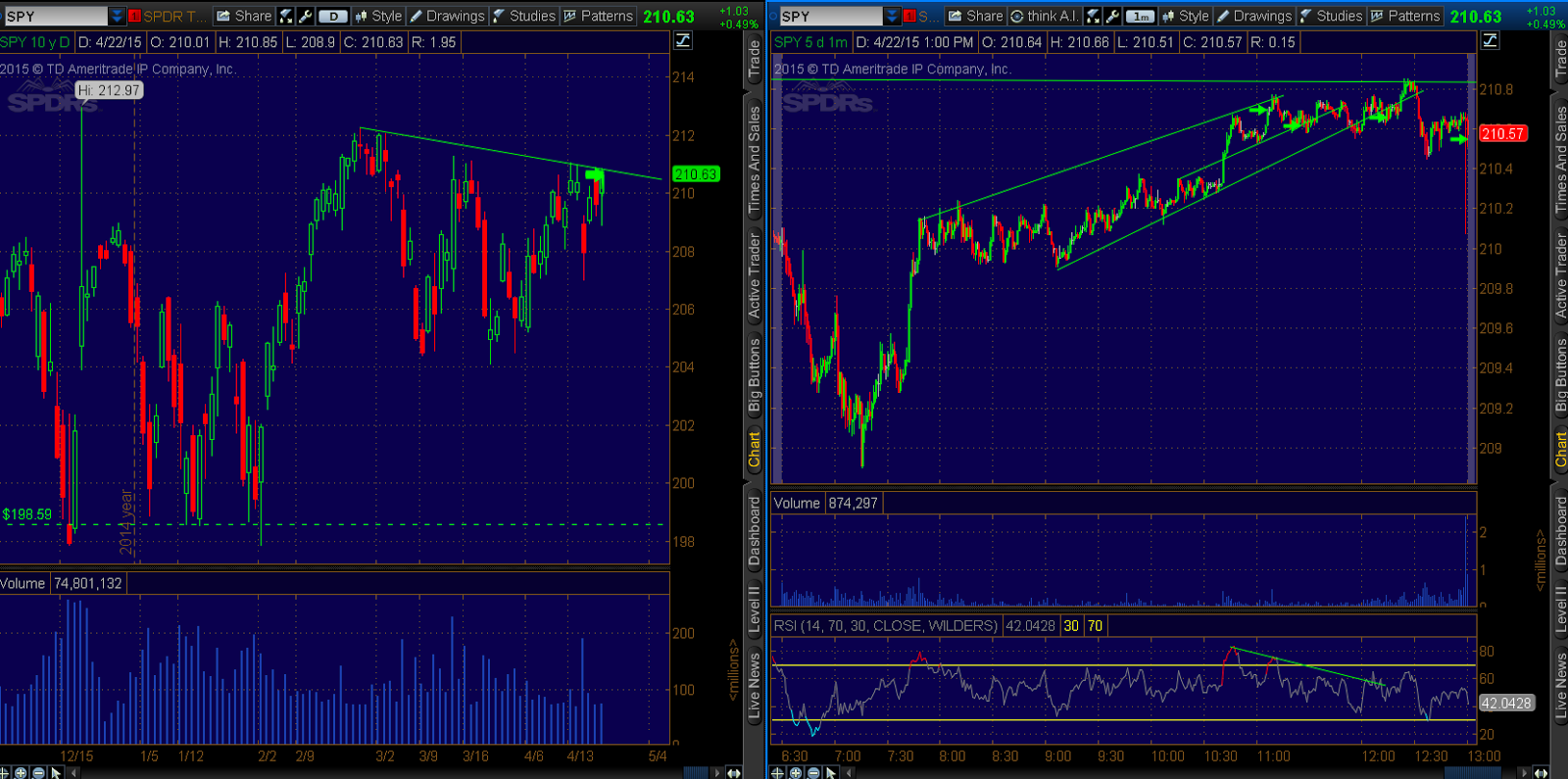

SPY

SPY

NEON

NEON

ECHO

I was hoping for home run on this to break green red but it bounced exactly from there where my gain was at the best 33.39 the R/G level

ECHO

WUBA

Did pretty crappy om this . mostly because of bad spread. It did what I expected but didn't I have good entries and had bad taking profit on the second try

WUBA

I didn't brake any rules is the most important , and didn't do anything compulsively.

I can live with it .

NOTE:

I was gettin in and out a lot when I was wrong almost instantly , and that'st why was costly trading, since I didn't nail anything very good. But in general this is better then wide stops on these type of overextended stocks, since they may run much higher then expected

Stay disciplined to stay green

Salute

VALE

VALE

SPY

SPY

NEON

NEON

ECHO

I was hoping for home run on this to break green red but it bounced exactly from there where my gain was at the best 33.39 the R/G level

ECHO

WUBA

Did pretty crappy om this . mostly because of bad spread. It did what I expected but didn't I have good entries and had bad taking profit on the second try

WUBA

I didn't brake any rules is the most important , and didn't do anything compulsively.

I can live with it .

NOTE:

I was gettin in and out a lot when I was wrong almost instantly , and that'st why was costly trading, since I didn't nail anything very good. But in general this is better then wide stops on these type of overextended stocks, since they may run much higher then expected

Stay disciplined to stay green

Salute

Wednesday, April 22, 2015

Green day shorting ADXS WUBA QUNR ECHO SPY all winners

It was a lot of action , all green by EOD besides the in and outs losses all executed per plan, so it is a double tap on shoulder when day is green and when it is green without breaking the rules. As a bonus tap on shoulder , I did it when SPY was making all new high of day all the way till the daily resistance as well as QQQs running strong .

WUBA

A winner on the first try is always good to reinforce the confidence.

WUBA

A winner on the first try is always good to reinforce the confidence.

WUBA the short

ADXS

Also winner at the first try short

ADXS the short

QUNR needed a few tries and it dived down beautifully, covered at always predetermined risk reward , although now I'm thinking maybe I shall trail the stops better and let it ride for home runs?!? Hmm ..Will note this to myself at the end.

QUNR the short multiple tries

but well worth sticking to the idea

ECHO

ECHO the short multiple tries too

ended up quite all-right besides the choppiness

SPY

SPY this was a regular day . nothing was overextended like I do on my other stock picks, but just wanted to prove that a good plan with strict rules can always be just good! , regardless how it ends win or loss. I have fear from trading the indexes THE MOST , they are the choppiest, the hardest to trade for me but as people say, to beat the fear you must face it.

Thank you @AmyAtrade for your post last night:

Fear kills more dreams then failure ever will !!!

So I did face the SPY and even made few bucks .

My rule to trade indexes or ETFs : Trade them only at major daily support and resistances , major inflection points , or I get chopped out ( so I have my nick name DaChopa, was destroyed in the past from choppy stocks)

Congrats to those who made big on $VLTC , BTW , condolences to those who got buried. Been there done that, many times !!

Stay green stay disciplined

Salute

Tuesday, April 21, 2015

Green day shorting GERN REN BIOC VGGL XUE

Green day is always good specially when is 3rd in a row without breaking rules.

GERN

I did OK job recycling it ,but it could have been better. Taking profits at intra-day supports is pretty good , so re-entering is less stressful after locking gains even for few cents. It is just the though that sabotage my mind saying: "it will crash it will crash, and I will leave money at the table "... but in reality crashes and home runs do not happen too often. Even if it does crash and I am out with profit IT IS STILL GOOD ! I did not lose !.Easier said then done. but it is all practice and hard work . not easy at all. ( not for me at least )

GERN the recycle

Emotionally I felt quite all right and was confident in this short since the daily resistance was just that: A RESISTANCE at 4.50. Confirmed with failed break of HOD and divergence in the RSI was a easy green light.

REN

Same overextended set up on daily double tops with RSI divergence.

REN short 1.55

REN the cover

I did get greedy here and covered with much better target so I'd say little luck on my side. Normally I stick to 1:2 risk reward except when I have a good start I may allow more room to play with targets.BIOC

Ah well perfect entry but was just too afraid of losing today and covered at break even , and missed an entire home run all day fade. It is OK though , what matters is that what I do it does work.

BIOC short 3.96 covered 3.95

Just to see this later on :

BIOC ahh well

One of the reason I covered at br even , I though it may spike up by the long chasers and run to 5.00 which could have been much better shorting there. I wish if I was perfect bu I'm far from it.

VGGL

If I took profit after the first entry I was gonna be focused on re-entering. But I took break even ( 3 c gain) at the time when I had to re -enter. That's what happens when I am out of timing with taking profits. Next time maybe better.

VGGL only 3 c gain due to not taking profit

XUE

I even tweeted it that I knew I was rushing in this one , see my tweet here See my tweet here

Maybe I should have waited to get to 3.70 area first but was anxious to make another trade with which one I ended the day, Got stopped per plan so I consider it as good trade.

XUE the red short

Stay green and disciplined

Salute !

Subscribe to:

Comments (Atom)