This was written last night:

SPY

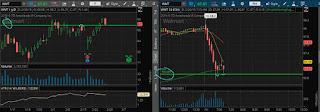

This is what we see now.

SPY 2 min

SPY is near by major resistance 195.00 . Let's see where it will be in the PM.. This will be related to any Big Board Stock not necessarily only to trading the SPY or SSO.

Scenarios:

1) SPY gaps down we will have PDC, 200 sma, 20 sma, Prev day congestion area of resistance above. This will be short build up into the move up towards those levels and stop above PDH

2) Opens gap up : it can be right into 195 resistance, so 2 min candle open break down, short the break stop above the 2 min candle. I would take 1:2 gain but will definitely leave some in case it crushes way lower

3) Opens above PDC, above 200 sma, above 20 sma. That will be long, but I will not go long it is just me, it may go 10 or more days up we never know that , but after 3 days up I feel uncomfortable going long

This is all planned based on 2 min range from the open and may change later into the day using 5 min or even 15 min candles is very possible, depending on the stock and the way it trades.

This is my plan and who ever trades they shall know: trading is risky and nothing is guaranteed. Losses can be bigger then what you actually have in your account , and

YES, YOU CAN LOSE EVERYTHING !

Salute

@DaChopa

**********************************************************************************************************************************

NVDA I'd short 2 min open break down stop above

WMT I'd long 2 min open break out stop below

Both are far away from 20 sma

On both targets 1:2 or 1/2 of the gap and would leave some for more to maybe fill the gaps

FB coming out of channel 2 min open break out for long, It is above

1) PDC

2) above 20 sma

3) above 200 sma on 2 min chart

They all act as support will not fight them if trades below and WILL cut losses in such case

FB at 105.70 mail line to trade long above 2 min break

What really can change all this is the range of the 2 min opening candles , they may be too big, but we ll see

**********************************************************************************************************************************

THIS WAS WRITTEN TODAY :

UPDATE DURING TRADING HOURS :

NONE of the planed set ups triggered ..frustrating right ? None of the 2 min opening candles were broken in the direction I planned to trade

FB Seeing it on daily there were possibilities to come out of the daily channel and move up, being a laggard in this crazy market rallying with gaps up 3 days in a row (SPY). So why not trade FB long?

The opening 2 min candle broke down, falling right into the previous day close, the 20sma and above the 200sma, First 2 min candle break above was a trigger long 105.30 all twitted ahead of time CLICK HERE. Risk below the same 2 min candle twitted HERE and FB stopped out with a 30c loss saving much bigger losses twitted HERE

Now seeing FB failing a clear long set up, did not make me feel comfortable shorting it just because it did not have many days overexertion like the QQQ. I was afraid It may come back up and start chopping which would piss me off and who knows what else I may do after. Dr. Jekyll and Mr. Hyde that's me when I trade and I bet bet many of you. I may preach all the good stuff but I may still do the dumbest things out of frustration.

FB 2 min trigger long off of 20 sma PDC over 200 sma

FB the failed long GOOD LOSING TRADE per plan

FB How much the stop loss saved me ?

GOOD TRADE !

QQQ

However failing FB long gave me some confidence to short QQQ. There were many other stocks doing similar thing but it doesn't really matter, all it matters is to make few bucks from any symbol. SPY rolled over the 200 and 20 after so many days above them AAPL was weak. So why even bother be in so many trades , I used to do that but at the end of day it doesn't matter to me.

QQQ droped below the 20 SMA and risk above 102.50 was something I could handle and I was in totally in peace if the 102.50 got hit. That would be pretty good sign for me to give it up today and I promised myself I will not trade today any more if it gets hit.

Twitted HERE the short entries

Twitted HERE why I was shorting QQQ

Twitted HERE the confidence from SPY roiling over

QQQ building short on the way up with stop 102.50

QQQ covering for profit

I wanted to have 1:4 risk reward , but was just dropping too slowly and after taking half off with 36 c gain which is more then the 25c I risked. I covered the rest on the 5 min candle break ou 101.86 or so.

I mentioned in this

TWIT HERE the QQQ ATR. One of the reasons why I like the Big Boards is that have very well known range THE ATR google it

HERE . They are not like many penny stocks, or low floats who can trade on any quadruple or more range range at any time on soem news , or pump or so I am not saying it is impossible to trade them, but I find great comfort in equation where I have one variable well known: the ATR, and that is pretty much firm number on the big cap stocks

I built 2,000 shares QQQ short average 102.26 covered 1,000 at 101.90 and 1000 at 101.86.

That was all for today.

This is not easy ,but do not feel bad if you had red day. I've had years and years of pain losing. I bet you have not lost more then me.

Find one set up you may feel comfortable with and try to do only that one for several months with very small size. Trading can not be though or learned by reading any book or by reading my journal. It can be learned only by doing it .Know you will lose , so do it small before you see, you feel and you know you can make green days consistently with "your eyes closed"

Too bad none of the 2 min open today triggered so I could not show you how you can end the day in 30 min green and close the shop till the next day.

Salute

@DaChopa