This was a good losing trade, per plan, without any improvisations to bail out by forcing trades.

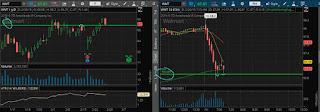

WMT

Markets opened in green, were pretty strong.

WMT gave nice short at 2 min and 5 min opening range break down short , but having the green markets I did not go for the short.

Watched the dive all the way down to the whole number 67.00 into the 200 sma on 5 min. so took the long in anticipation to re-trace 50% into the big opening drop.

But it was hammered down by sellers on any attempt to go above 67.20.

The 20 sma cought up with the price ( the price did not bounce to catch up with the 20 sma) so it gave a good short which I did not want to take just because it already had quite a big over-extension of 1 ATR. So not big deal there will another trading day. I'd rather have these controllable losing days within the normal limits then the huge PnL swings.

WMT 5 min risk level

WMT anticipation 50% entrancement bounce

WMT creating higher lows

WMT eod

Once the 20 sma was touching the price, it was a great short set up but simply I did not take it because it was already overextended, SPY was green, so I was cautions not to get cought in a squeeze.

Once the 20 sma was touching the price, it was a great short set up but simply I did not take it because it was already overextended, SPY was green, so I was cautions not to get cought in a squeeze.

SPY all day in green Will 195 hold ?

Have a great weekend

@DaChopa

Thnx for posting

ReplyDeleteThnx for posting

ReplyDeleteYou are welcome glad it helps

DeleteYou are welcome glad it helps

Delete