Don't count how many green days I have in a row,

but count how many days in a row I do not brake my trading rules.

Id suggest to read this first before going further

See Handling The Losers

So this is day No 3.

It was just one of those boring days with couple of boring trades , and I really wish this could continue forever.

JCP , CLNE and SPLK

I chose them primarily because of the much above average volume, starting as of pre -market

JCP was a total no brainier, got long on the pull back after the initial push out of the gate 8.11 laser precision entry used time and sales prints.( I was twitting only the CLNE trade so my buddies will not confused with too much information)

The idea was to buy long since it was basing into great daily support area .8.00 end of November, mid January and mid February. Clear swing highs if you look at the daily chart and some consolidation during February. Was not very sure still if this may run all day like it did , so took profit selling into the first pop 8.20. At this point I was still not sure if the 8.07 low will hold, but felt good that I took the profit and observed Time N Sales knowing that I can always re -enter if price action confirms. I re-entered again long at 8.18 on speculation this higher low 8.13 may hold, which at same time was my risk definition just like I did yesterday when I had few small losers.

Once it cleared the 8.20 and made NHOD , I was looking for the next pull back to define my tighter risk which was 8.30. The NHOD made me feel more confident , since the trade was basing from the 8.00 daily level, and the volume today was much greater, way above average.

I did sweat out here when it hit twice 8.30 and made double higher lows. Then it made NHOD which totally made me confident to stay in this winner and be more patient knowing the 8.30 is my exit if goes south.Then the new higher low 8.35 was made, after which the trade was on a cruise control till I sold entire position at 8.55 in the small wash leaving a lot of money on the table , but grateful for what ever market gave me. I am not even woried any more like in the old days , about the money I left on the table.Why? Because most of the times that home run will not happen, at least not for me. My risk was 7 or 8c took profit above 30 cents on this second entry , and the first was 9 cents gain.

I like when the reward was 5 times the risk.What esle I could ask for?

That's the reason why I closed it all although JCP went all the way to 8.90!!

Great trade , all good, no mistakes and I was in total emotional control.

|

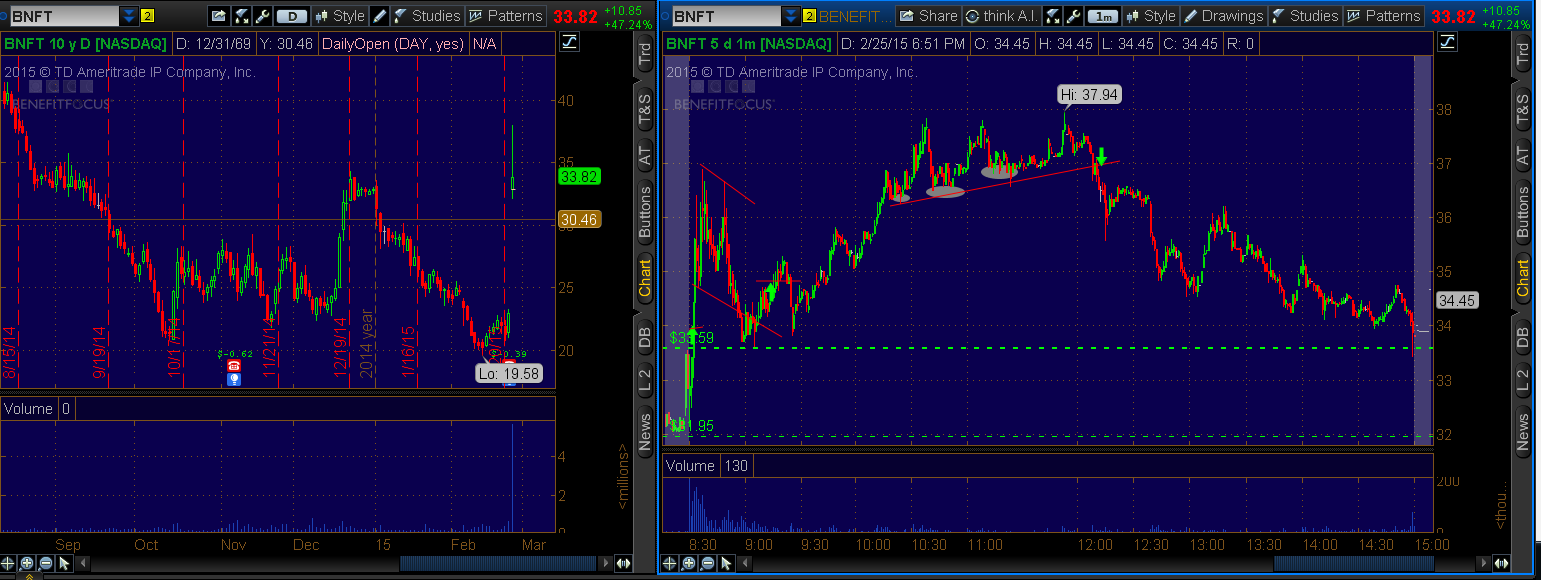

| JCP daily JCP 1 minute |

Pre-market very active trading on above average volume , and above major daily level 5.40s which was a swing high Dec 23 and Feb 13. In a hindsight Id always buy at least small starter position at the drop towards the 5.40 support , right out of the gate , but I didn't this time since I wanted to take the smallest risk possible and be an example of good rule trader for my buddy.

I had JCP , CLNE and SPLK on my main focus. I like to keep watching few stocks simultaneously without flipping screens and listen to www.radiomela.it .

Long on first pull back 5.67 with risk below this first higher low 5.59 exited 5.84 after the flag was broken downwards. Very good risk reward, risked 7 cents took 14. This wil never happen ( for me ) trading a stock on regular average volume. Id get chopped out most of the time. Been chopped out so much so I got the nick name DaChopa, not that I'am any good at it , but being annihilated by chopping myself to death. $7,000 loser on BAC trying to get a momentum on average trading day on average volume is lesson well learned and way way well over paid.

Next entry was with wider risk, since the break out on the daily on such volume was too convincing for me that this could make NHOD. I ve seen it too often. This is one of the highest probability long trade in my book considering the massive volume. Was driving and monitoring the trade form my phone. So twitting was dangerous.

CLNE flag to be either broken up ( to stay long ) or down ( to take profit )

Forming the bullish flag, or ABCD, or triangle or so .

And so it did go to NHOD and trailed the stop with confidence .

If I was a good chopper, Id be scalping the pops and buying the dips , but need a lot more practice and speed for it. I am feeling good doing it the way I do so far. That will be my next step in future.

SPLK I didnt enter a long

I watched it and had the vision on how to enter, but pure luck I did not enter or I was gonna take a loss. which still would have been OK, IMO.

|

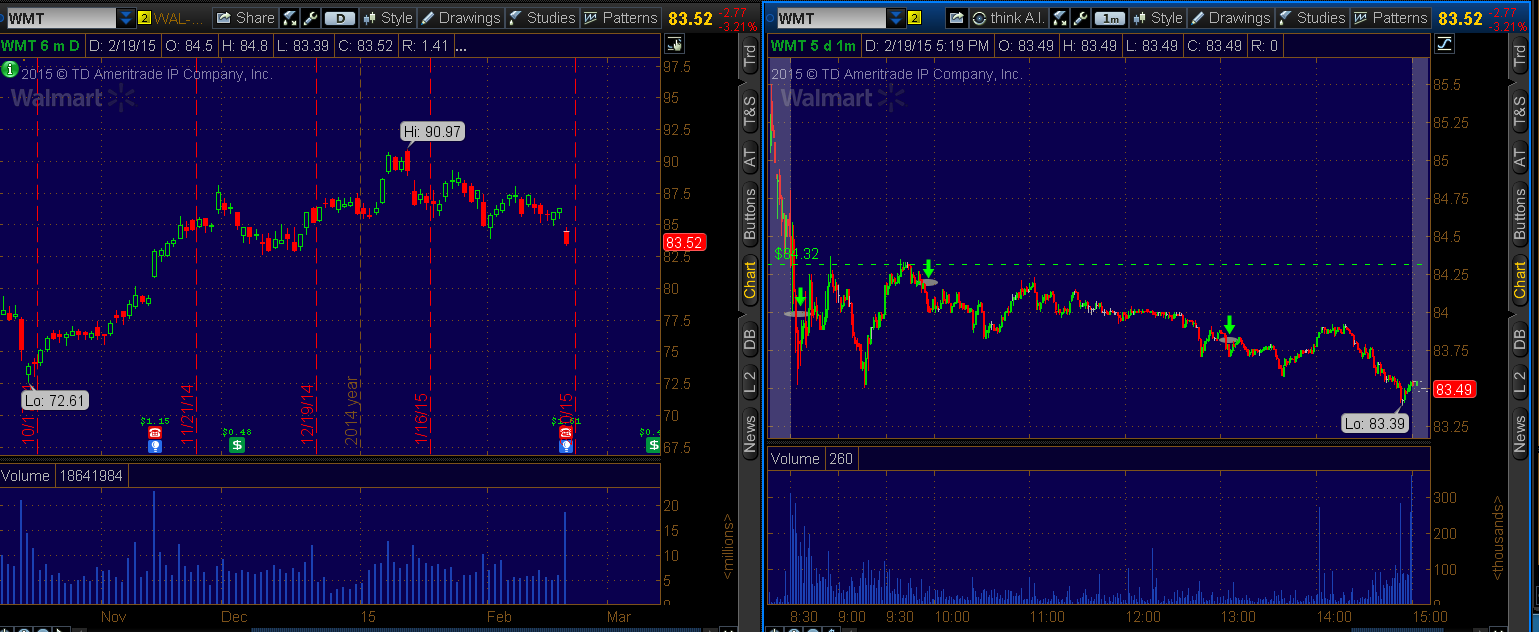

| SPLK visual plan |

Salut !