Long term big picture : downtrend all the way to 5 year support level 6.00 after which short term trend is upwards with close above 7.00, holding short term support 7.20.

|

| SFUN weekly |

|

| SFUN Daily |

|

| SFUN 2 day 5 min |

Finally when it did it closed 2 days in a raw above 7.20, and today is having an INSIDE DAY ( powerful pattern / indicating a consolidation before potential explosive move ).

I am comfortable with the size, comfortable that I can lose 10c, Although depending on how it will open tomorrow I will tighten up the stop. I never ever widen the initial risk after I enter a trade. ONLY LOWER THE RISK, use every up move to reduce the risk.

The size is appropriate with the overnight risk I can sustain, in event of major news, a disaster, nuclear war or so ...pardon if nuclear war all I have to worry about is not to lose my sward :)). In other word, let's say the stock drops 50%, that loss shall be not more then 10% of my acct. Do I really practice that? Maybe I will when I become Warren Buffet. Till then I understand trading is risky and yes I may lose a lot more then per plan. Over-Night exposure can make the loss lot bigger then the planned 10 cents. But hey, its OK with me as long as I am aware of it. During the trading session, I observed the time and sales closely. I noticed there were lot bigger size printing at the ask, spatially after every pull back. Also I noticed when a big prints were at the bid, price was moving a tick up. I think that is absorption by somebody. I believe somebody was quietly loading up during this inside day, and I believe tomorrow or day after SFUN may pop above 7.50 , which was PDH (Previous Day High) after which will have a clear pathway to 8.00. Along the way I will lock in some gains. That's the plan if I am right. If I am wrong, I already explained at first: risk is 10 cents below 7.20, or so depends how it will trade near that area, if it does so.

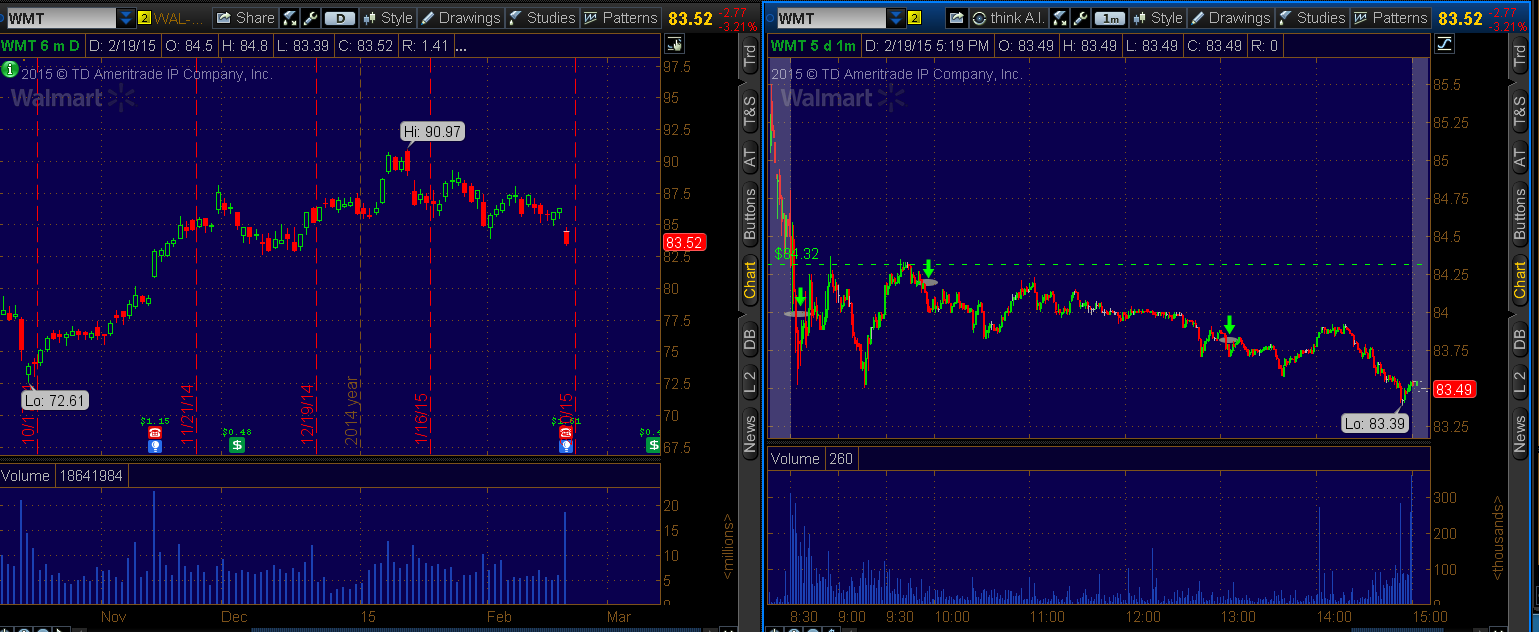

WMT

Pre-market big volume today , they reported earning, or so, I did not even bother reading the news at that time, because it may just confuse my reading of the price action, which was clearly short biased. So I looked to go short which I did in partials.

WMT short 84.00

Now that I red the ER, hmm SO GLAD I DID NOT READ IT IN THE AM :). Earnings were better then estimated , so a normal mind would be a buyer , not seller. Lost a lot of money before in the past trading by the meaning of the news. Price action is what I go by. No other indicators !!! I want the most clear and most simple picture on the chart. Clean desk, clean chart, clean mind.

|

| WMT daily , intra-day 1 min |

Was I 100% sure this short will work out ? No way , that is never 100% possible. So what did I go by? Here is my thinking and reading the price action:

1) Huge volume pre-market, expecting a nice move during the session, for a day trade

2) 84.00 major swing low daily

3) Over under 84.00 will be the battle, will it hold will it break?

After open 3-4 min into the open , broke the LOD so it was my short entry. I say I do not like to enter break outs, but when volume is so above average , there is a chance to truly miss the drop, so I entered small size just to be in , and get the feel for for it. I said I will add if it goes to HOD ( High Of Day) with risk HOD, on entire position.

Will add close to ( near ) high of day I meant

It went up to 84.20, then 84.30, was looking to go to HOD to add but never did. Instead , it dropped all the way down to LOD, where made double bottom. Mistake here I'm talking in hind sight, I should have would have taken profit, but my size was so small I figured , "let it break LOD and drop more to lock it in, and then to short again on pull up at better price"

My real time thought

After the double bottom, went up to 8.30. and made double top with previous intra-day high 8.30. The idea I had was: I will add to my short , so I can have better size , with risk above the double top, 8.30. So I added more size 84.18

Added short 84.18

|

| WMT 1 min , adding short 84.18 avg 84.09 |

I decreased the original risk ( tightened the tolerance for loss), the HOD is no more my original risk level , just because the 8.30 double top was newly created resistance that allowed me to risk without sweating much.I NEVER WIDEN THE RISK once I am in trade ONLY TIGHTEN IT.

- The trading is game of losing. So lose less, while allowing to make more.

I know and plan that every trade will be a loser , no matter how much I wish, I want, I love and I expect it to go my way. Can I live with myself if I lose X amount of dollars? Can I be comfortable losing that much? Can I buy food tomorrow if I lose today? This sounds boring to me too, as well as to whoever reads this, but I have lost a lot, till I learned this the hard way. I am much more comfortable shorting then longing, so I primarily focused on the SFUN trade watching every tick , every print, every Level2 market maker (MM), how are they stacked, the size of the bids the offers, the prints. Cant help it , love doing it. When I am wrong and when I lose, it is really frustrating, and hard to bear the fact that I spent all day watching tick by tick , analyzing every possible scenario , watching new support resistances as they are created , and at the end I am having a red day. It is a hard work, so I try to at least simplify it to the dumbest level so I stay rested instead of exhausted.

I covered most of the WMT 83.70 and left small size over night (risk break even ), since the price action tells me this has room to go lower maybe gap down tomorrow off the gate or so. Daily chart next support is 83.00 which is my target. Or break even if it starts moving up.

|

| WMT covered 2/3 size |

From my watch list there were no gap up opens , none gave me My Favorite Set Up so is the reason I traded just those two.

Tomorrow on watch for short EGRX, ARRS, NMBL, THRX, ASTI,

1) Daily overextended

2) Gap up open with possible parabolic move up out of the gate

3) If there is run into daily resistance level over / under is a plus

4) Short first weakness, tight stops unless I have plan to add and size in smaller positions

It may look like a lot of tickers, but I will eliminate those that will not open with gap up, so right out off the gate I will know what to focus on.

For long :

TRUE need a weak open pull back to 20 as near as possible then long with risk 20.00 or so

UPL need a weak open pull back to 16 as near as possible then long with risk 16.00 or so

PEIX need break above 10.00 to hold 10.00 and long with risk 10.00 or so

AMRN if holds 1.40 maybe a long, if good volume .

Usually for those it takes more time till some of them drops , pulls back to the risk defined level.

It is not big deal to observe them when they are all spread over my monitors, so I don't even need to flip any other charts. This is relaxing set up and I know exactly what to look for.

I love talking strategies , so if anyone have something to say lets talk. Any good traders out there please share your thoughts where and how I can improve. Need to quit my corporate job.

I almost quit trading myself after huge losses in the past , but traders like @Modern_rock @EpicaCapital @InvestorsLive @Lx21 @johnwelshtrades @OzarkTrades @elkwood66

inspired me and

Thank you all.

Salute!

No comments:

Post a Comment